Motor Insurance

The term "motor insurance" describes policies for vehicles on the road, such as four-wheelers, commercial trucks, and two-wheelers. For all two-wheelers and four-wheelers in India, including cars, bikes, scooters, trucks that travel the roads, motor insurance provides financial protection against physical damage and natural disasters. Motor insurance is mandatory for all vehicles plying on the roads, including two-wheelers, four-wheelers, and boats. Even commercial vehicles can be covered by motor insurance.

Apply Now Contact UsMotor Insurance: Key Features

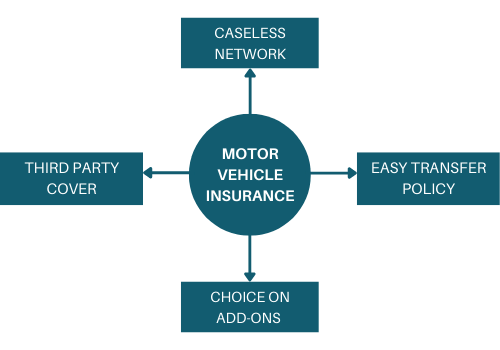

It can be very beneficial for the policyholder to have vehicle insurance that has several features. Here are some features are mentioned that you should know:

Stress-Free Process

You can easily buy and renew your automobile insurance online.Policy Schemes

You can even receive a discount on your insurance price.

Policy Cover

Along with accident cover, it also covers you from theft, natural calamity, fire damage, vandalism, manmade disasters, etc.cashless Claims

In case of accident, you can get benefit from cashless claims by presenting enough evidence.No Claim Bonus

The insurer will offer you a discount if you do not make a claim within the policy tenure on the premium or on purchasing any other add-on.Enough Plans

Insurance companies brings different plans and different add-ons that gives you better coverage and also provides assistance.Types of Vehicles Covered Under: Motor Insurance

To buy the best motor insurance, consider these main factors:

Car Insurance

Car insurance protects you against such unforeseen events like accident. Under this policy, the insurance company covers the cost of property damages & third-party injuries.

Two Wheeler Insurance

A two-wheeler insurance policy or bike insurance protects your bike or scooter. Two wheelers are covered against both own damage and accidental loss to third party properties or persons.

Commercial Vehicle

Commercial vehicle insurance is a specific type of insurance that covers damage caused by or to a commercial vehicle. It covers both parties engaged in the accident in the event of accident.