Home Insurance

One of the biggest decisions in life is buying a home. After earning hard-earned money for years, you finally buy your first home. Most people fail to protect this most important investment. Avoid being part of these statistics. A home is more than just a piece of real estate; it has many valuables.

Apply Now Contact UsWhat is Home Insurance ?

Your home and possessions are protected with home insurance. Get a quote today

Get protection against fire, theft, natural calamities and other unfortunate events with Apna Wealth's home insurance. If you are willing to pay any additional premium, we can cover all your important personal items. In addition to your jewelry, your home insurance covers your latest gadgets, expensive bags, gorgeous interiors, etc...

Coverage Scope

You can claim certain types of illnesses and surgeries during the policy term based on the type of coverage and the sum insured.

Insured Amount

The insured amount plays a significant role in choosing the right insurance policy. Larger insured amounts mean better coverage.

Policy Type

Medical insurance policies in India can entail a wide variety of coverage. It is up to you to select the one that best suits your needs.

Waiting Period

As soon as the initial waiting period is over, your health insurance policy takes effect. A minimal waiting period is available for some plans.

Co-payment

Several insurance policies contain clauses that require certain percentages of the claim amount to be borne by the you (insured).

Renewability Option

It is beneficial to consider adding an option for lifetime renewal when buying a health insurance plan.

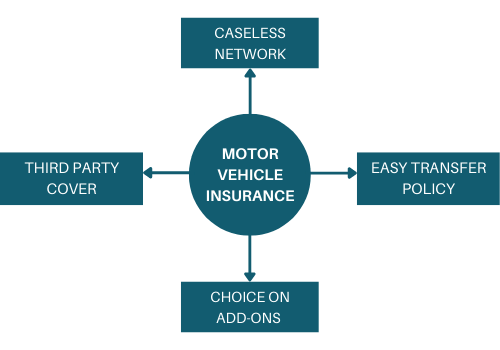

Cashless Network

You can also file a cashless claim at any one of the hospitals that is on the insurance company's list of network hospitals.

Rent Sub-limits

It's also possible to have various sub-limits in a health insurance plan, but the ones that typically apply to room rent are the most prevalent.